CHAPTER III - Research Methodology

3.Introduction

This section addresses about the research methodology adopted for the present study. The objectives of this research are to investigate the determinants of capital structure of the listed companies in Indonesia and to analyze how firms in the listed sector raise capital for investments, internally or externally. The steps involved in choosing the research approach with appropriate justification, appropriate data collection methods adopted are also explained in this chapter. “Methodologies refer to the overall approach to the research process, from the theoretical underpinning to the collection and analysis of data. Like theories, methodologies cannot be true or false, only more or less useful” was the definition provided Silverman to define pure research methodology (as cited in Hussey & Hussey, 1997, p.54).

3.1 Research Designs

In any business research, researchers have to explore their findings by providing systematic enquiry as mentioned by Cooper and Schindler (2003). There are different kinds of research usually adopted for the study which includes explanatory, descriptive, and exploratory. In the present study, researcher used exploratory research design, where it aims at assessing phenomena and new insights are obtained (Saunders et al, 2007). In the present study researcher attempted to identify the determinants of capital structure of the listed companies in Indonesia at various levels.

3.1 Development of Hypotheses

A major purpose of this paper is to estimate the relative importance of factors affecting Indonesia firm’s choice of capital structure. Financial theory and empirical results identify a number of variables that influence a firm's debt position in the context of country and firm levels (Rajan and Zingales, 1995; Booth et. al., 2001; Deesomsak et. al., 2004; De Jong et. al., 2008). In order to establish hypotheses about the determinants of capital structure in the sample, current capital structure theories and existing evidence are discussed as below:

3.1.1 Profitability

H1: Profitability has a negative effect on leverage

Myers (1984) suggests that companies may have a 'pecking order' and prefer internal financing to external financing. In other word, companies will have a hierarchy of financing from retained earnings (accumulated net profit), debts and equity. Cole (2008) measured profitability by the winsorised return on assets, and showed a consistent negative relation with the loan-to-asset ratio. The coefficients for ROA were significant at the 0.05 level for three of the four surveys, with 1998 being the exception. As a robustness test, they replaced return on asset with a simple zero-one indicator for profitable firms. They found that this variable had a negative and highly significant coefficient in each of the four surveys. These latter findings were strongly supportive of the pecking order theory, which predicted that profitable firms used less debt because they could fund projects with retained earnings, but it was inconsistent with the trade-off theory, which predicted that profitable firms used more debt to take advantage of the debt tax shield, and because they had lower probability of financial distress. Sbeiti (2010) found that firm profitability seemed to have a statistically negative and significant relationship with both the book and market leverage in the three countries.

3.1.2 Growth opportunities

H2: Growth opportunities have a significant effect on leverage.

There are two different arguments about how growth rate affects leverage. Since growth can enhance the firms' borrowing ability in the future, this would suggest that growth increases firms’ assets, and therefore higher leverage. Gupta (1969) suggests that a company with rapid growth will tend to finance the expansion with debt. Thus, this study suggests that rapidly growing firms should have higher leverage. But Myers (1977) argue that firms with higher growth rates tend to use less and or short term debt in their capital structure to reduce the agency costs. Titman and Wessels (1998) also note that firms usually attempt to invest in suboptimal projects in order to transfer wealth from bondholders. Since costs related to this type of agency problem is higher in rapidly growing firms, then firms use less debt in order to avoid this cost. Shah and Khan (2007) found that growth variable was significant at a 10% level and was negatively related to leverage. As they expected, this negative coefficient of -0.0511 showed that growing firms did not use debt financing. They concluded that their results were in conformity with the result of Titman and Wessels (1988); Barclay, et al. (1995) and Rajan and Zingales (1995). Sbeiti (2010) found a negative relation between growth opportunities and leverage and it was consistent with the predictions of the agency theory that high growth firms used less debt, since they did not wish to be exposed to possible restrictions by lenders. For this reason, growth rate should have a negative relationship with debt.

3.1.3 Non-debt Tax Shield

H3: Non-debt tax shield has a negative effect on leverage.

As predicted by the Trade-off Theory, a major motivation for using debt instead of equity is to save corporate tax. However, firms can use non-debt tax shields such as depreciation to reduce corporate tax. Thus, a higher non-debt tax shield reduces the potential tax benefit of debt and hence it should be inversely related to leverage. Previous studies that support this relationship can be found in DeAngelo and Masulis (1980), Rajan and Zingales (1995) and Deesomsak et al. (2004).

3.1.4 Firm size

H4: Firm size has a positive effect on leverage.

The trade-off theory claims a positive relation between firm size and debt, since larger firms have been shown to have lower risk and relatively lower bankruptcy cost (Myers, 1984). Therefore, firm size is expected to have a positive impact on leverage consistent with the studies by Marsh (1982) and Rajan and Zingales (1995).

3.1.5 The size of the banking industry and stock market development.

H5: The size of banking industry has a positive effect on leverage.

H6: Stock market structure has a negative effect on leverage.

There are two sources of financing for a firm, either in debt and equity or hybrid of both. Hence the above macroeconomic variables are important in determining the accessibility of fund to a firm. Demirguc-Kunt and Maksimovic (1999) and Booth et al. (2001) reported a positive sign for the relation between the banking sector/GDP and debt to asset. As for stock market factor, Demirguc-Kunt and Maksimovic (1998, 1999); Booth, et al. (2001); and Giannetti (2003) found a negative correlation between size of stock market and leverage level.

3.1.6 GDP growth rate.

H7: The GDP growth rate has a significant effect on leverage.

The empirical evidences on the relationship between the GDP growth rate and capital structure are not definite because some findings show different results. La Porta et al. (1997) and De Jong et al. (2008) show a positive relationship between GDP growth rate and leverage. On the contrary, however in Demirguc-Kunt and Maksimovic (1998), a negative effect of GDP growth on leverage is found.

3.1.7 Inflation

H8: The inflation has a significant effect on leverage.

Empirical studies have found mixed results of the effect of inflation on capital structure. For example, Homaifa et al. (1994) find a positive relationship between leverage and inflation as inflation reduces the “real” cost of employing debt via the erosion of the repayment of the principal. However, the studies by Booth et al. (2001) and Fan et al. (2006) show that insignificant relationship between leverage and inflation but leverage is positively related to economic development

3.2 Selection Measures

The selection measures for dependent variable (leverage; which is proxy to capital structure) and independent variables (country and firm-specific) are detailed as below.

3.2.1 Leverage

The broadest definition of leverage is the ratio of total debt to total assets. It provides insight to a firm's policy for both short-term debt and long-term debt. Ferri and Jones (1979) used this leverage measure in their empirical studies. They argue that as a firm increases its use of debt, its financial leverage and risk also increases. This ratio can also be viewed as a proxy of what will be left for shareholders in the case of liquidation. However, Rajan and Zingales (1995) argue that total debt may overstate the level of leverage. Total debt includes accounts payable that may be used for transaction purpose rather than for financing. Thus, it is not a good indicator of whether the firm is at risk of default in the near future. According to these authors, a more appropriate definition of leverage is the ratio of long tem debt to total assets. Another issue to be considered is whether to use book value or market value. According to Titman and Wessels 1998, market value of debt is a better measure than book value of debt. As Harris and Raviv (1991) argue, the choice of measures for both leverage and the explanatory variables is crucial, as it may affect the interpretation of the results. Rajan and Zingales (1995) also show that the determinants of capital structure are sensitive to the measure of leverage. The measure of leverage based on the market value of equity, rather than the book value, was finally chosen as it gave more theoretically consistent results, in line with Wiwattanakantang (1999), Suto (2003) and Deesomsak et al. (2004). In this study, the leverage ratio, the dependent variable, is measured as:

3.2.2 Size of the banking industry and stock market

BANK = size of the banking industry

STKMKT = size of stock market

The magnitude of banking sector in a given country is measured by the ratio of the assets of domestic banks to GDP (BANK) [Joeveer, 2006; Song and Philippatos, 2004; Demirguc-Kunt and Maksimovic, 1999]. The variable of ‘size of equity market’ used in this research is the stock market capitalization divided by GDP (STKMKT) [De Jong et al., 2008; Joeveer, 2006; Booth et al., 2001]. The source of data is taken from The World Bank: A New Database on Financial Development and Structure.

3.2.3 GDP growth rate

The GDP growth rate is defined as the average of annual real GDP growth rate (unit in percentage) of each country, averaged through 2007–2011 (Source: Euromonitor International). [De Jong et al., 2008; Frank and Goyal, 2003; Booth et al., 2001]. The growth potential of a firm can be measured by many different variables. Rajan and Zingales (1995) measured growth as Tobin‟s Q, Laarni Bulan and Zhipeng Yan (2009) measured growth as market-to-book ratio as market equity/book equity, and Akhtar and Oliver (2006) defined it as the average percentage change in total assets over the previous four years. We measure growth opportunities as: Growth = the ratio of market value of assets (book value of assets plus market value of equity less book value of equity) to book value of assets.

3.2.4 Inflation

Inflation rate used in this study is defined as annual inflation rate (in percentage) of each country (Source: Euromonitor International). [Booth et al., 2001; Jose, 2001 and Fan et al., 2006]

3.2.5 Profitability

Profitability plays an important role in leverage decisions. Profitability is proxied by return on assets. ROA represents the contribution of the firm‟s assets on profitability creation. Profitability is a measure of earning power of a firm. The earning power of a firm is generally the basic concern of its shareholders. Profitability is measured by normalizing the firm's earnings before interest and taxes (EBIT) with total assets. [De Jong et al., 2008; Deesomsak et al., 2004; Aggrawal and Jamdee, 2003; Booth et al., 2001]

3.2.6 Firm growth

Firm growth is defined as the total assets minus book equity plus market equity over book total assets (or market-to-book value of total assets). [De Jong et al., 2008; Deesomsak et al., 2004; Aggrawal and Jamdee, 2003]

3.2.7 Non-debt Tax Shield

Non-debt tax shield is measured by the depreciation expense over book value of total assets during the sample period. [Deesomsak et al., 2004; Song and Philippatos, 2004]

3.2.8 Firm size

Firm size provides a measure of the agency costs of equity and the demand for risk sharing. Firm size is likely to capture other firm characteristics as well (e.g., their reputation in debt markets or the extent their assets are diversified). Firm size defined as the natural logarithm of total revenue. [De Jong et al., 2008; Aggrawal and Jamdee, 2003; Booth et al., 2001]

3.3 Sampling Design

The sample will be based on the index-linked to the stock exchange of the Indonesia. LQ 45 is a stock market index for the Indonesia Stock Exchange. The LQ 45 index consists of 45 companies that fulfil certain criteria, which are: (a) included in the top 60 companies with the highest market capitalization in the last 12 months; (b) included in the top 60 companies with the highest transaction value in a regular market in the last 12 months; (c) have been listed in the Indonesia Stock Exchange for at least 3 months; and (d) have good financial conditions, prospect of growth and high transaction value and frequency. It is calculated semi-annually by research & development division of Jakarta Stock Exchange.

3.4 Data Collection Procedure

3.4.1. Secondary data collection

Firm-specific and country-specific determinants are the two major types of variables used in analyzing the impacts on firms’ leverage choice. The firms in the sample covered in Indonesia, an emerging and developing markets. Data for leverage and firm-specific variables are collected from Bloomberg, Financial Times and Reuters database. In the sample, financial companies are excluded. Data on country-specific variables are collected from a variety of sources, mainly World Development Indicators and Financial Structure Database of the World Bank and Euromonitor International.

The sample period covers the years 2008–2011. One of the requirements is that the firms in the sample must have at least four years of available data over the study period. This timeframe is selected to gauge the aftermath effect of the Asian financial crisis in 1997 on the capital structure decisions. The selection of a time-period involves a trade-off between the countries and the availability of enough firm-specific data. Whenever needed, some other sources to collect any missing data are looked into. It is still impossible to obtain data for each and every variable from all four countries during this time period.

Firstly, all the most recent components of listed companies included in the stock exchange indexes are collected and initial total sample size is XXXX companies. However, out of this, financial companies make up of forty eight companies are eliminated from the sample which leaves only XXX companies. Companies not meeting the requirement of five-years are seventy two companies. The final sample consists of XXX firms. In the sample, for companies with different fiscal years, the absolute year is taken into account. Example, companies with a fiscal year of 31 March 2008, and then year 2008 was considered for simplicity purpose.

In the model following variables has been used

| Variable Type | Variable | Unit | Label |

|---|---|---|---|

| Dependent | LEVERAGE | In USD mn | Leverage ratio |

| FIRM SPECIFIC VARIABLES | |||

| Independent | PROFIT | In per cent | Profitability |

| Independent | GROWTH | Points | Growth opportunities |

| Independent | NDTS | Points | non-debt tax shield |

| Independent | SIZE | - | FIRM SIZE |

| COUNTRY SPECIFIC DETERMINANTS | |||

| Independent | GROWTH | Points | Growth opportunities |

| Independent | BANK | - | S&P 500 Standard deviation |

| Independent | STK | size of stock market | |

| Independent | GDP | ||

| Independent | INF | - | annual inflation rate |

| Independent | Er | Rs. Per USD | sNominal exchange rate |

PROFIT, GROWTH, NDTS and SIZE) and later add the country-specific determinants (BANK, STK, GDP and INF)

3.4.2. Primary data collection

In addition to the secondary data

this study adopted a semi-structured interview data method which involved interview questions which are open ended in nature (O' Leary, 2004) The main aim of interview schedule was to ensure that it obtain richer information and allows emergence of data by capturing respondents rich descriptions of phenomena in this case determinants of capital structure that affects the firm. Thus, an appropriate interview guide consisting of ten broad questions was designed and presented in email form before starting the interviews. It enabled the interested respondents to come out with required information before actual interview which was collected among firm owners (CEO) of the listed companies. Appendix A presents the interview questions.

3.5 Data Analysis Techniques

Ordinary-least-squares (OLS) regressions are employed to determine whether relations exist between leverage ratio and determinants. Eviews 6.0 software developed by Quantitative Micro Software is used to analyze the OLS regressions. Two regression equations is used to test the hypotheses which are looking at firm specific determinants (PROFIT, GROWTH, NDTS and SIZE) and later add the country-specific determinants (BANK, STK, GDP and INF) to the first equation. The model of regression equation is as follows:

Leverage = ∝+β_1 (profit)+β_2 (growth)+β_3 (NDTS)+β_4 (size)+ ε

Leverage= ∝+β_1 (profit)+β_2 (growth)+β_3 (NDTS)+β_4 (size)++β_5 (bank)+β_6 (STKMKT)+β_7 (GDPRATE)+β_8 (INF)+ε

Where α = constant, β1 to Β8 = coefficient of explanatory variables, PROFIT = Profitability; GROWTH = Growth opportunities; NDTS =non-debt tax shield; SIZE = firm size; BANK = size of banking industry; SKTMKT = size of stock market; GDPRATE = GDP growth rate; and INF = annual inflation rate. ε is the error term The first regression equation is to determine the firm-specific factors influencing leverage in the individual countries whereas the second regression is to examine the country effect on the leverage. This approach is consistent with previous studies as in Deesomsak et al. (2004) and Song & Philippatos (2004).

Rationale of the statistical analysis

1. Stationarity tests

The regression model as stated above should be estimated after conducting the Stationarity test which analyse the most appropriate form of the trend in the data. Prior to analysis, particularly when using ARMA modelling the data must be transformed to stationary and trend needs to be removed. The test was conducted in order to identify the presence of unit roots (trending data) in all variables included in the study. In the present study researcher adopted “Augmented Dickey-Fuller (ADF) test” by Dickey and Fuller (1979). This test is used to check for the homoscedasticity of residual errors and independency (or deterministic, stochastic or combination of both).

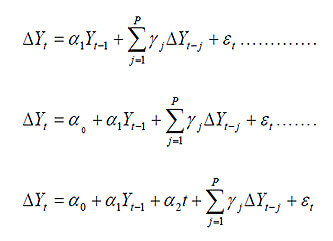

The Augmented Dickey Fuller (ADF) test (1979, 1981) is used for this purpose. The three different ADF Regression equations are

Where et is white noise. The additional lagged terms are included to ensure that the errors are uncorrelated. The tests are based on the null hypothesis (H0): Yt is not I (0). If the calculated DF and ADF statistics are less than their critical values from Fullers table, then the null hypothesis (H0) is accepted and the series are non-stationary or not integrated of order zero.

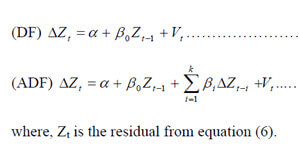

In the second step we estimate co integration regression using variable having the same order of integration. The cointegration equation estimated by the OLS method is given as Yt = a0 + a1 Xt + zt

In the third step residuals (Zt) from the cointegration regression are subject to the Stationarity test based on the following equation.

The sequential procedure involves testing the most general model first. Since the power of the test is low, if we reject the null hypothesis, we stop at this stage and conclude that there is no unit root. If we do not reject the null hypothesis, we proceed to determine if the trend term is significant under the null of a unit root. If the trend is significant, we retest for the presence of a unit root using the standardized normal significant, we retest for the presence of a unit root using the standardized normal distribution. Otherwise it does not. If the trend is not significant, we estimate equation and test for the presence of a unit root. If the null hypothesis of a unit root is rejected, we conclude that there is no unit root and stop at this point. If the null is not rejected, we test for the significance of the drift terms in the presence of a unit root. If the drift term is significant, we test for a unit root using the standardized normal distribution. If the drift is not significant, we estimate equation (10) and test for a unit root.

At the 5% significance levels the null hypothesis could be rejected and similarly if the p value was greater than α = 5% which at the 5% significance levels, the alternative hypothesis was rejected.

3.6 Chapter Summary

The hypotheses developed for this study are to analyze the relationship between capital structure and its determinants such as country-specific (size of banking industry and stock market, GDP growth rate and inflation rate) and firm-specific variables (profitability, growth opportunities, non-debt tax shield and firm size). The final sample companies are taken from the main stock indexes of Indonesia Stock Exchanges for the five years period from 2007 to 2011 and later the data are analyzed using the ordinary least squares regression.