Big Data Application To Predict Macroeconomic Indicators

Introduction

For quite a period, private agencies and government institutions are collecting and unifying information on several aspects of the economy, and over the period the opportunity of data collection has sufficiently grown, and therefore the quality of data has been enhanced. Nowadays, data are free to the general public on a daily schedule, nearly every day, new data become obtainable and are examined, remarked and construed. Monitoring of macroeconomic conditions has become the regular job of devoted economists at private institutions, banks, and government agencies, who scrutinize through big and complex data to refine all vital information.

Big Data Search

An

apt place for a calculation of the prospective welfares and expenses of the Big Data

use for macroeconomic prediction is the identification of the source. A

foremost source is signified not only by human-sourced information otherwise

known as Social Networks, which mainly explain to include social networking,

but also e-mails, internet searches, comments, blogs, videos, pictures, etc.

The allied data is roughly organized and frequently ungoverned.

Big

Data’s second key source is process mediated data, otherwise called as Traditional Business Systems (TBS). These developments track

and observe the interest of business events, like accepting an order, record

keeping of a customer, manufacturing a product, etc. TBS data is the massive

majority of what IT achieved and handled, in both business intelligence and

operational systems. Generally, designed and deposited in database systems can

be further assembled into data shaped by businesses and public agencies.

The

third source is the fast-expanding benefactor of Big Data, known as the Internet of Things (IoT). This data is derivate

from machines which are used to track and calculate occasions and progress in

the modern era. The concise way of data generated from the machine is apt for

computer processing, but its size demands the usage of new statistical

methodologies.

Looking

from the viewpoint of economic prediction, all these above mentioned three

types of Big Data are theoretically related. For instance, selected social

networks, IoT, TBS could all give relevant leading indicators for Gross

Domestic Product growth of a nation. So, a vital step for the usage of Big Data

for prediction is an arrangement of selected data, along with the features of

the targeted variable.

Designing Big Data strategy

We

can continue to implement and categorize once Big Data is once temporally

designed and well cleaned. This can implement several econometric procedures to

equalize the target indicator with variables of Big Data. After the

implementation, we can conduct sample cross-validation of the substitute

methodologies. A conjoint method for the ventilated data is to either execute

expectations or collect the data on the econometric models. Without any doubt,

these expectations are not valid, and aggregation of data leads to a loss of

data. So, Big Data econometrics is mandatory.

In

real-time, for monitoring macroeconomy and prediction with big data, Bayesian vector autoregression (BVAR) deals with a substitute modeling

framework. Vector auto regressions (VARs) are the most linear framework and are

broadly used in macroeconomics. In VAR

each and every variable hinge on its past and the outline of connection of the

forecast faults in different variables is left unrestricted. In BVARs, all the

variables are independent when combined with this high level of complexity. VAR model in economics has already been backed by the primary

exponents of these models. According to a recent study, it’s resulted that they

are firmly allied with factor models and are appropriate for the scrutiny of

big data. BVARs are also applicable for prediction since they can perform in a

space form letting for accessibly treating data with the help of filtering procedures.

This is a significant way of study since Bayesian inference delivers a coherent

model framework that can be misused to lessen the number and significance of

subjective choices like the transformation of data.

Conclusion

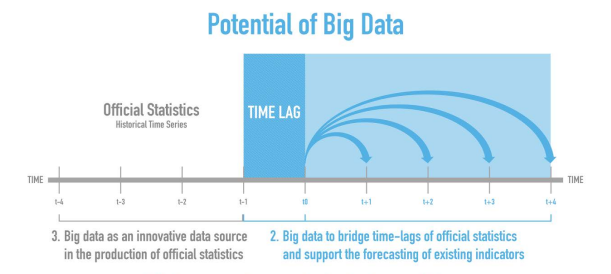

Generally, we tend to assure that

Big Data is appreciated in an exceeding nowcasting framework, not only to cut

back the errors but to boost the suitability, occurrence of release and scope

of data. The methodology developed during this article needs more extensions

and changes, for instance, to think about a lot of consistently the conversion

from filtering problems, unstructured to structured big data, many prediction

methods and Bayesian estimation, a lot of cautious real-time estimations, and

other methods to present the outcomes.

Even if the projected

architecture is common enough to be instigated with any technology, its

approval is not without any complications. To comment on some of them, the

combination of the architecture in the present organizational systems is a

perilous procedure to ensure the period of forecasts and nowcasts. The

implementation of the frameworks in an apt cloud computing situation so that

the operation can balance easily is also critical. As future work, we have a

strategy to implement the anticipated Big Data architecture to publish and

create real-time predictions and forecasts of some macro-economic models using

Internet data.

Learn More

- Online big data-driven oil consumption forecasting with Google trends, 2019, Lean Yu, Yaqing Zhao, Ling Tang.

- Big Data and Social Indicators: Actual Trends and New Perspectives, 2016, Enrico di Bella, Lucia Leporatti, Filomena Maggino

- Forecasting with Big Data: A Review, 2015, Emmanuel Sirimal Silva

Previous Post

Previous Post Next Post

Next Post